COVID Relief - Section by Section

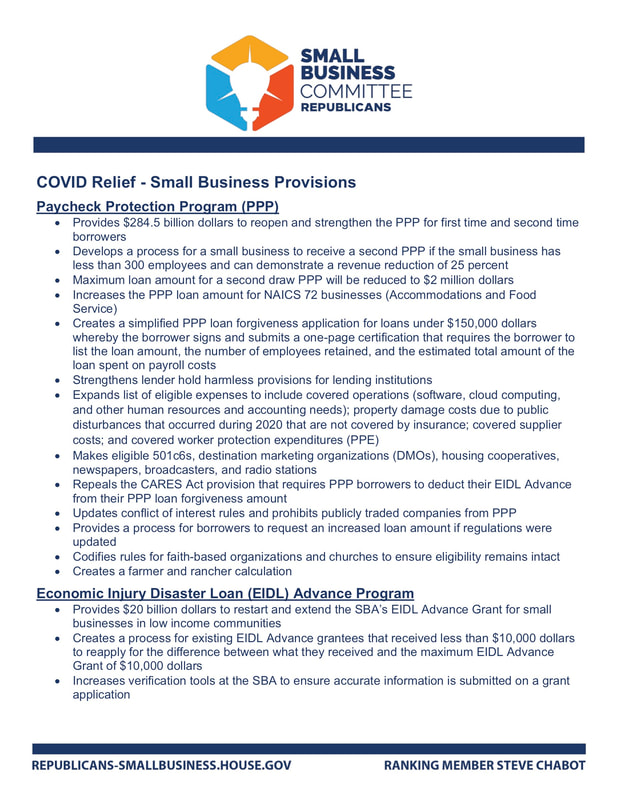

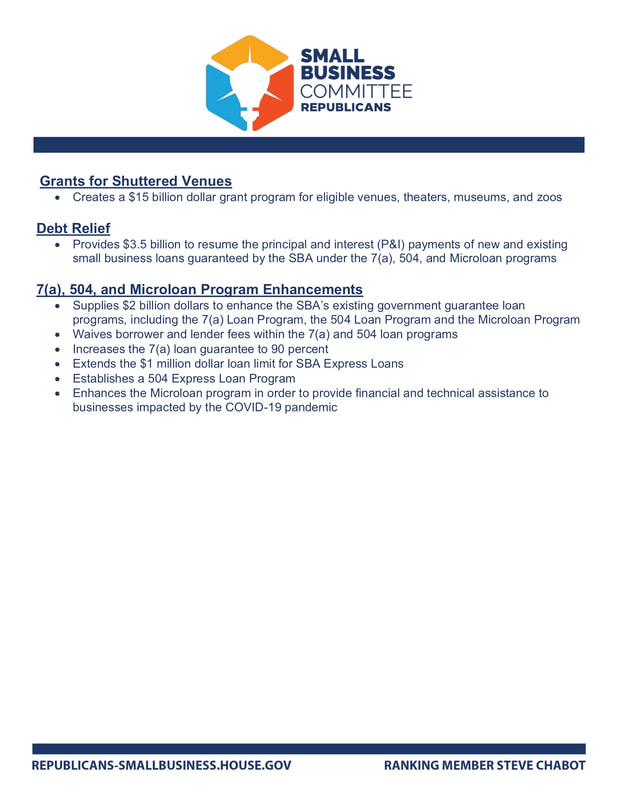

COVID Relief - Small Business Fact Sheet

SBA to Make Economic Injury Disaster Loans Available to U.S. Agricultural

Businesses Impacted by COVID-19 Pandemic

WASHINGTON – U.S. Small Business Administration Administrator Jovita Carranza announced today that agricultural businesses are now eligible for SBA’s Economic Injury Disaster Loan (EIDL) and EIDL Advance programs. SBA’s EIDL portal will reopen today as a result of funding authorized by Congress through the Paycheck Protection Program and Healthcare Enhancement Act. The legislation, signed into law by the President one week ago, provided additional funding for farmers and ranchers and certain other agricultural businesses affected by the Coronavirus (COVID-19) pandemic.

“For more than 30 years, SBA has been prohibited by law from providing disaster assistance to agricultural businesses; however, as a result of the unprecedented legislation enacted by President Trump, American farmers, ranchers and other agricultural businesses will now have access to emergency working capital,” said Administrator Carranza. “These low-interest, long-term loans will help keep agricultural businesses viable while bringing stability to the nation’s vitally important food supply chains.”

Agricultural businesses include businesses engaged in the legal production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)). Eligible agricultural businesses must have 500 or fewer employees.

The SBA will begin accepting new EIDL applications on a limited basis only, in order to provide unprecedented relief to U.S. agricultural businesses. For agricultural businesses that submitted an EIDL loan application through the streamlined application portal prior to the legislative change, SBA will move forward and process these applications without the need for re-applying. All other EIDL loan applications that were submitted before the portal stopped accepting new applications on April 15 will be processed on a first-in, first-out basis.

For more information, please visit: www.sba.gov/Disaster

Businesses Impacted by COVID-19 Pandemic

WASHINGTON – U.S. Small Business Administration Administrator Jovita Carranza announced today that agricultural businesses are now eligible for SBA’s Economic Injury Disaster Loan (EIDL) and EIDL Advance programs. SBA’s EIDL portal will reopen today as a result of funding authorized by Congress through the Paycheck Protection Program and Healthcare Enhancement Act. The legislation, signed into law by the President one week ago, provided additional funding for farmers and ranchers and certain other agricultural businesses affected by the Coronavirus (COVID-19) pandemic.

“For more than 30 years, SBA has been prohibited by law from providing disaster assistance to agricultural businesses; however, as a result of the unprecedented legislation enacted by President Trump, American farmers, ranchers and other agricultural businesses will now have access to emergency working capital,” said Administrator Carranza. “These low-interest, long-term loans will help keep agricultural businesses viable while bringing stability to the nation’s vitally important food supply chains.”

Agricultural businesses include businesses engaged in the legal production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)). Eligible agricultural businesses must have 500 or fewer employees.

The SBA will begin accepting new EIDL applications on a limited basis only, in order to provide unprecedented relief to U.S. agricultural businesses. For agricultural businesses that submitted an EIDL loan application through the streamlined application portal prior to the legislative change, SBA will move forward and process these applications without the need for re-applying. All other EIDL loan applications that were submitted before the portal stopped accepting new applications on April 15 will be processed on a first-in, first-out basis.

For more information, please visit: www.sba.gov/Disaster

Gov. Lee announces expiration of stay at home order for 89 out of 95 counties

https://files.constantcontact.com/8e46c2f5601/c26e0928-7a41-4810-a3c9-864f7bdb74b9.pdf

https://files.constantcontact.com/8e46c2f5601/c26e0928-7a41-4810-a3c9-864f7bdb74b9.pdf

Essential Employees Offered Access To Free Child Care During COVID-19

The Tennessee Department of Human Services announced last Friday a partnership with the YMCA and Boys and Girls Clubs to provide child care to essential workers. There will be temporary locations set up and a payment assistance established for parents who are essential workers to provide child care at no cost. The COVID-19 Essential Employee Child Care Payment Assistance program will last through June 15, 2020. Applications for payment assistance are accepted online and will last throughout the state of emergency.

The Tennessee Department of Human Services announced last Friday a partnership with the YMCA and Boys and Girls Clubs to provide child care to essential workers. There will be temporary locations set up and a payment assistance established for parents who are essential workers to provide child care at no cost. The COVID-19 Essential Employee Child Care Payment Assistance program will last through June 15, 2020. Applications for payment assistance are accepted online and will last throughout the state of emergency.

Treasury Department Issues Guidance on Paycheck Protection Program

Assistance for American Workers and Families

In the weeks immediately after the passage of the CARES Act, Americans will see fast and direct relief in the form of Economic Impact Payments. For more information,CLICK HERE.

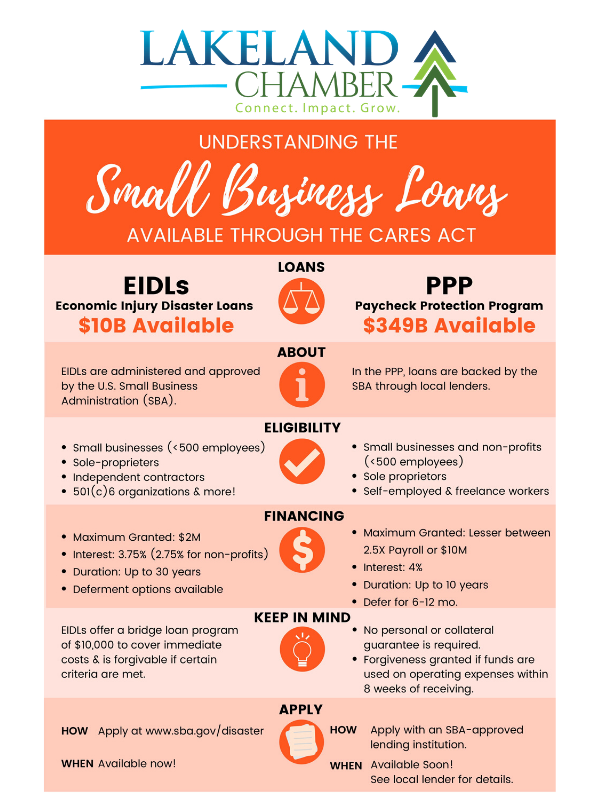

Assistance for Small Businesses

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses. Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Assistance for American Workers and Families

In the weeks immediately after the passage of the CARES Act, Americans will see fast and direct relief in the form of Economic Impact Payments. For more information,CLICK HERE.

Assistance for Small Businesses

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses. Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

- For a top-line overview of the program CLICK HERE

- If you’re a lender, more information can be found HERE

- If you’re a borrower, more information can be found HERE

- PPP Borrower Application Form (Updated 4/2/20)

- PPP Lender Application Form

- PPP New Lender Application Form (Federally Insured Depository Institutions, Federally Insured Credit Unions, Farm Credit System Institutions)

- Paycheck Protection Program – Interim Final Rule

- Paycheck Protection Program – Interim Final Rule on Affiliation

- Paycheck Protection Program – Applicable Affiliation Rules

- Find an eligible lender

- Frequently Asked Questions